home buying interest rates today

Here are historical average annual interest rates for popular home loan products. Since the beginning of the year the interest rate on a 30-year mortgage loan has climbed from about 3 to nearly 7 making it much more expensive to buy a house.

If its lower than that you should hold off and see if interest rates will go down in.

. Heres what you need to know if youre thinking about buying a home in the near future. The cost of a point depends on the value of the borrowed money but its generally 1 percent of the total amount borrowed to buy the home. The average rate for a 15-year fixed mortgage is 643 which is a decrease of 4 basis points compared to a week ago.

For example in a 2-1 buydown. Discount points are basically prepaid interest that reduces the interest rate on your mortgage. Home Buying Interest Rates Today Nov 2022.

Year 30-YR FRM Rate 30-YR Points 15-YR FRM Rate 15-YR Points 1-YR ARM Rate 1-YR Points 1-YR Margin. State Bank of India is offering attractive. If mortgage rates are around 550 and your mortgage is above 625 refinance is a good idea.

Looking for current interest rates for mortgages. On Friday November 11 2022 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year fixed mortgage rate is 6910 with an APR of. Interest rates could rise at any moment Federal interest rates dropped from 158 in.

Learn how you can save money by comparing mortgage interest rates from different lenders. Credit is the biggest factor in interest rates on both mortgages and all other lending products so making sure credit balances are below 30 is key to maximizing a credit score. Last week the Federal Reserve raised its benchmark rate by 075 to a target range of 375 to 4.

Mortgage rates currently are. Average mortgage rates today. But things are starting to change.

Interest rates have been very low since 2009 when they were cut to just 05 in reaction to the fallout of the financial crisis. Buying points upfront can help you. Todays average 30-year fixed mortgage rate is 691.

Youll definitely have a higher. Loan type Interest rate A week ago Change. One discount point costs 1 of the loan amount and will usually drop the interest rate by 025.

15-year fixed-rate mortgages. Home Buying Interest Rates Today - If you are looking for a way to reduce your expenses then our trusted service is just right for you. Four savings accounts now pay 5pc or more - locking in shrewd move as inflation peaks Savers can get more than five percent a year interest from a best buy fixed-rate bond.

In part because the process of buying a. As part of the upcoming festive season in the country leading banks are offering special home loan offers to attract customers to avail home loans. Under this type of arrangement a seller buys down the interest rate a home purchaser will have to pay in the initial years of their mortgage.

Thanks to the higher price tag on that home your monthly payments have risen and youre almost maxing out your budget. When these rates go up its not uncommon for loan rates to go up as well. A 15-year fixed rate mortgage on the other hand may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed.

Your down payment amount has risen too. The average 20-year fixed-rate mortgage currently sits at 669.

How Mortgage Rates Affect Home Buying Now And Going Forward Lakeland Real Estate

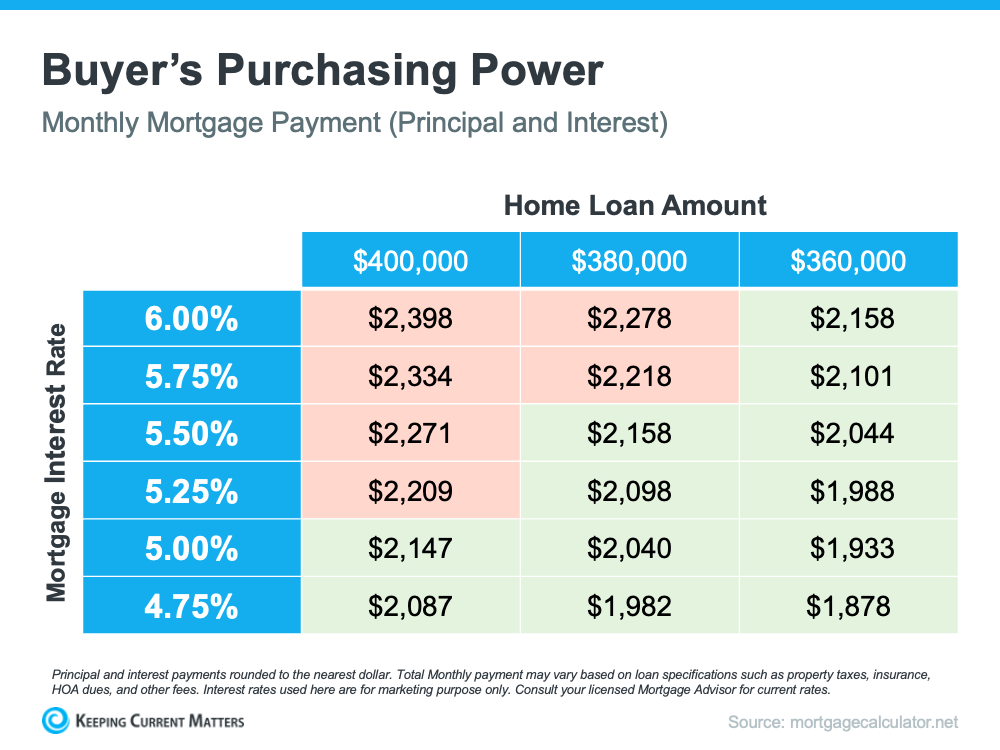

Rising Interest Rates Are Affecting Buying Power For Buyer Using A Mortgage

Mortgage Interest Rates Today For Nov 10 2022 Rates Increase Slightly Cnet

As Interest Rates Rise What Will It Cost To Wait To Buy A New Home

Mortgage Catch 22 Interest Rates Are Lower Than Ever But Millions Of Borrowers Can T Get A Loan

Mortgage Interest Rates 20 Lower Tallahassee Home Loan

Current Home Loan Interest Rates In Colorado Mortgage Solutions Financial

Are You Waiting For Buying Home Check How The Rising Mortgage Rate Will Affect Your Monthly Payment Har Com

Why Home Buyers Should Comparison Shop For Mortgage Rates But Don T Wsj

Mortgage Bankers Predict Mortgage Rates To Drop To 5 4 By End Of 2023 A Year Ago They Forecast 4 By Now But Now We Re At 7 Wishful Thinking By Crushed Mortgage Lenders Wolf Street

The Buying Power Of Lower Mortgage Rates The New York Times

Interest Rates Archives Page 4 Of 7 Voila

Compare Today S Mortgage Interest Rates Nextadvisor With Time

Low Interest Rates Provide Opportunity For Home Buyers 1 Mark Spain Real Estate

Waiting To Buy In Chicago Could Mean Higher Mortgage Payments Chicago Agent Magazine Local News

How Rising Interest Rates Will Impact Housing Affordability Phoenix Az Real Estate And Homes For Sale

Mortgage Rates Jump Above 6 For First Time Since 2008 The New York Times

Buy A Home Now Or Later Context On Rising Rates Home Prices